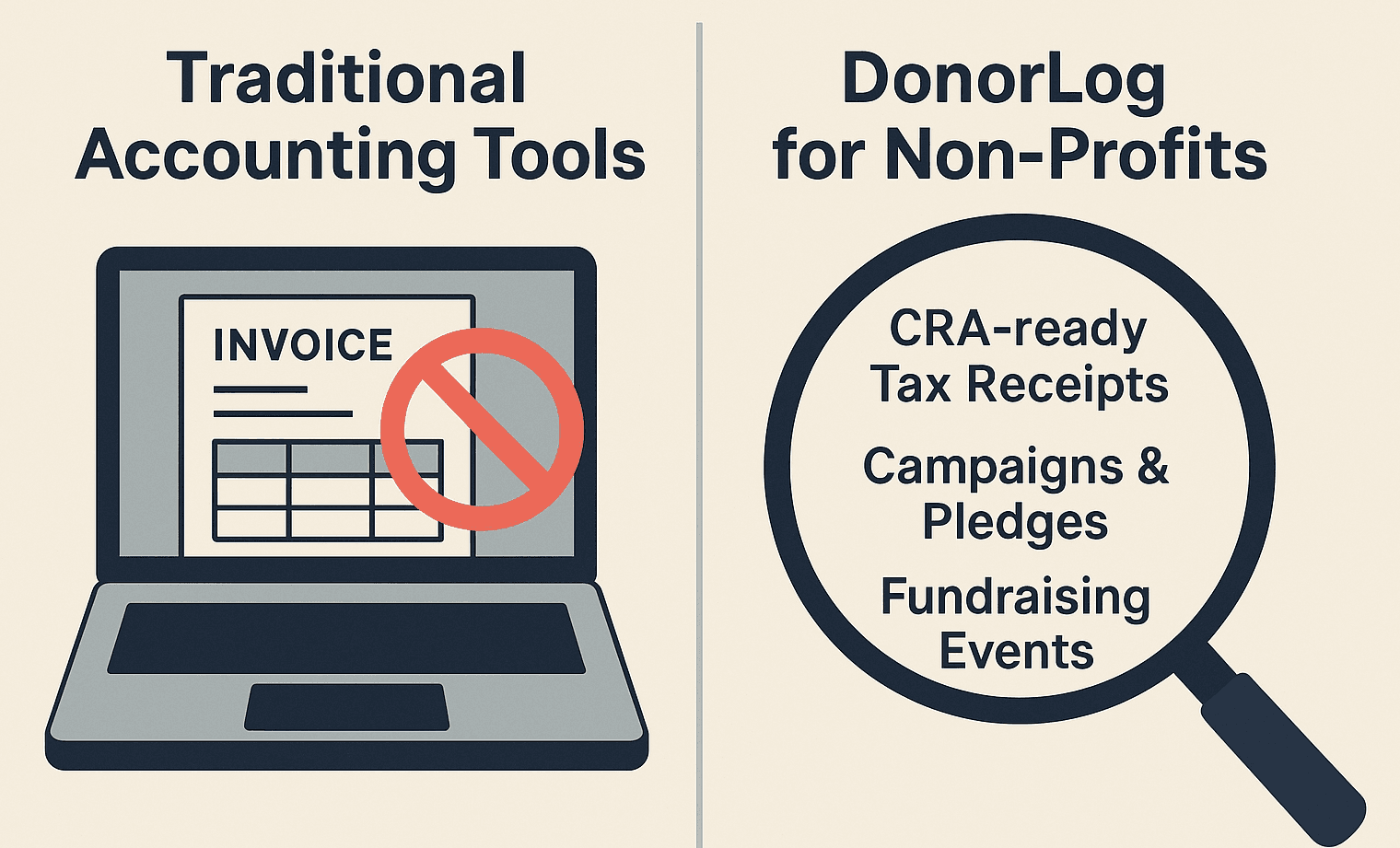

When non-profits look for software to manage donations, track expenses, and stay organized, many start with traditional accounting tools. These platforms are great for small businesses, they handle invoices, bookkeeping, and general financial workflows quite well.

But there’s a problem: non-profits don’t operate like businesses, and their needs are very different.

Here’s a breakdown of why typical accounting solutions fall short for charities, mosques, and community organizations, and how DonorLog is built to bridge that gap.

1. Traditional Accounting Tools Aren’t Built for Donations

Business tools are designed for invoices, sales, and expenses — not donors, pledges, or charitable giving.

Traditional accounting tools:

. No CRA-compliant tax receipt generation

. No campaign or pledge management

. No fundraising event workflows

. No donor-specific reporting

. One-time reminders at best

DonorLog:

✅ CRA-ready digital tax receipts

✅ Dedicated donor CRM

✅ Campaigns, pledges, recurring donations

✅ Event-based fundraising support

✅ Smart reminder & follow-up system

✅ Expense tracking (business-level detail, but nonprofit-friendly)

2. Transparency vs Hidden Fees

Some accounting tools keep their pricing low upfront, but add extra transaction fees or charges in the backend.

Traditional tools:

. Hidden or variable fees

. Add-ons for extra features

DonorLog:

✅ Clear, transparent monthly pricing

✅ Everything included — no surprises

3. One-Size-Fits-All vs Customized for Non-Profits

Business tools are stable and professional — but rigid. They aren’t designed to adapt to mosque or charity workflows.

Traditional tools:

. Built for generic business use

. Hard to customize

. Limited focus on donor relationships

DonorLog:

✅ Tailored for mosques and non-profit teams

✅ Direct access to the founder

✅ Able to add custom features quickly

✅ Actively growing based on feedback

4. Smarter Insights With AI

Most accounting tools stay surface-level — numbers in, numbers out.

DonorLog adds intelligence:

✅ AI-powered donor insights

✅ Smart predictions and recommended follow-ups

✅ Automated donor engagement tools

5. Audit-Ready for CRA Requirements

This is a major stress point for many charities in Canada.

DonorLog helps reduce stress:

✅ Audit-ready donation history

✅ Organized, searchable records

✅ No more manual spreadsheets or mismatched data

Final Thoughts

Traditional accounting tools are great for what they are: business accounting platforms. But non-profits need more than bookkeeping — they need tools that support community, transparency, donor engagement, and compliance.

That’s why DonorLog was built — not as a business tool adapted for charities, but as a non-profit-first platform created with the real workflows of mosques, charities, and community organizations in mind.

If your organization relies on donations, fundraising, and CRA-compliant receipting, choosing a platform designed specifically for your needs makes all the difference.